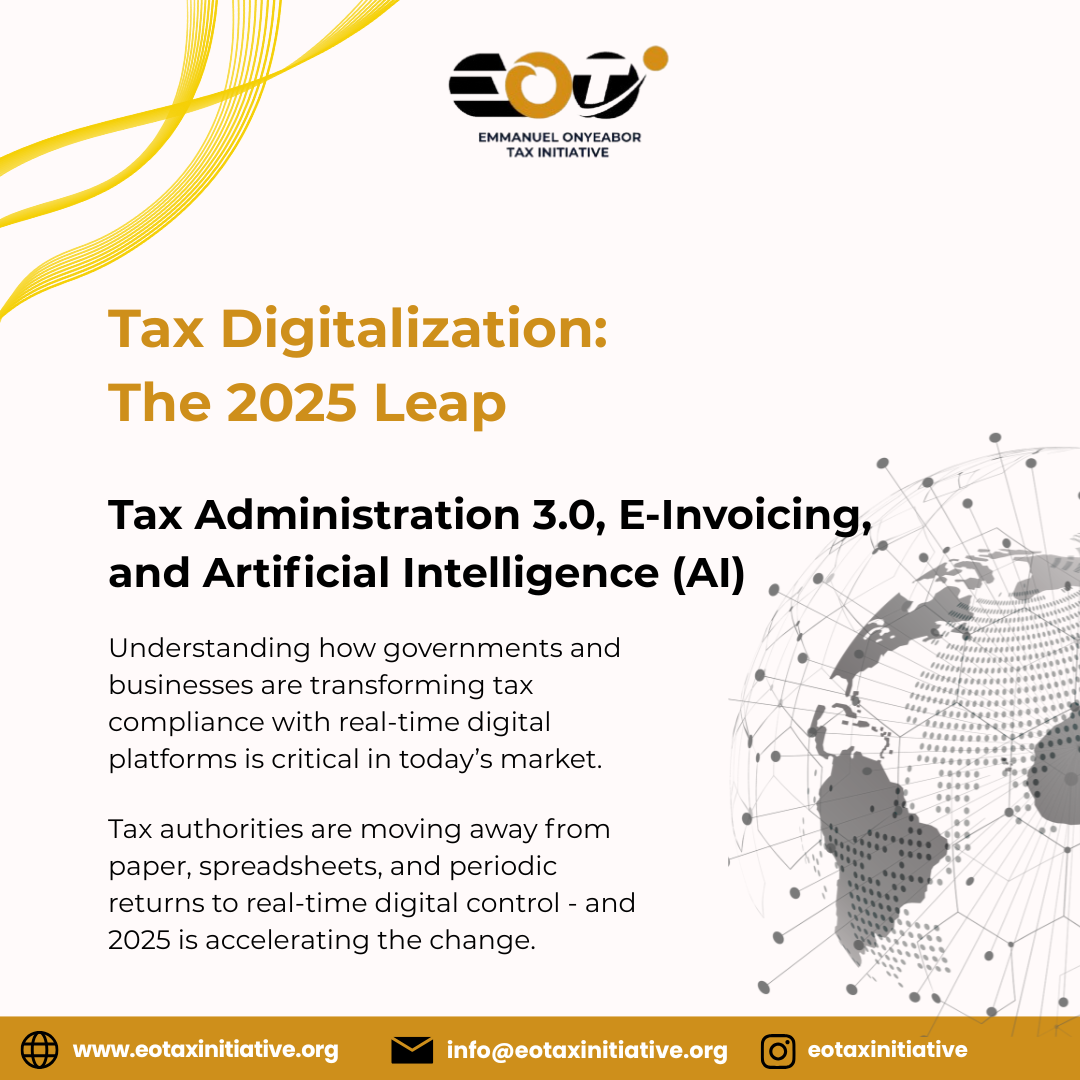

Tax Administration 3.0, E-Invoicing, and Artificial Intelligence (AI) are at the heart of tax digitalization in 2025. Understanding how governments and businesses are transforming tax compliance with real-time digital platforms is critical in today’s market. Tax authorities are moving away from paper, spreadsheets, and periodic returns to real-time digital control – and 2025 is accelerating the change.

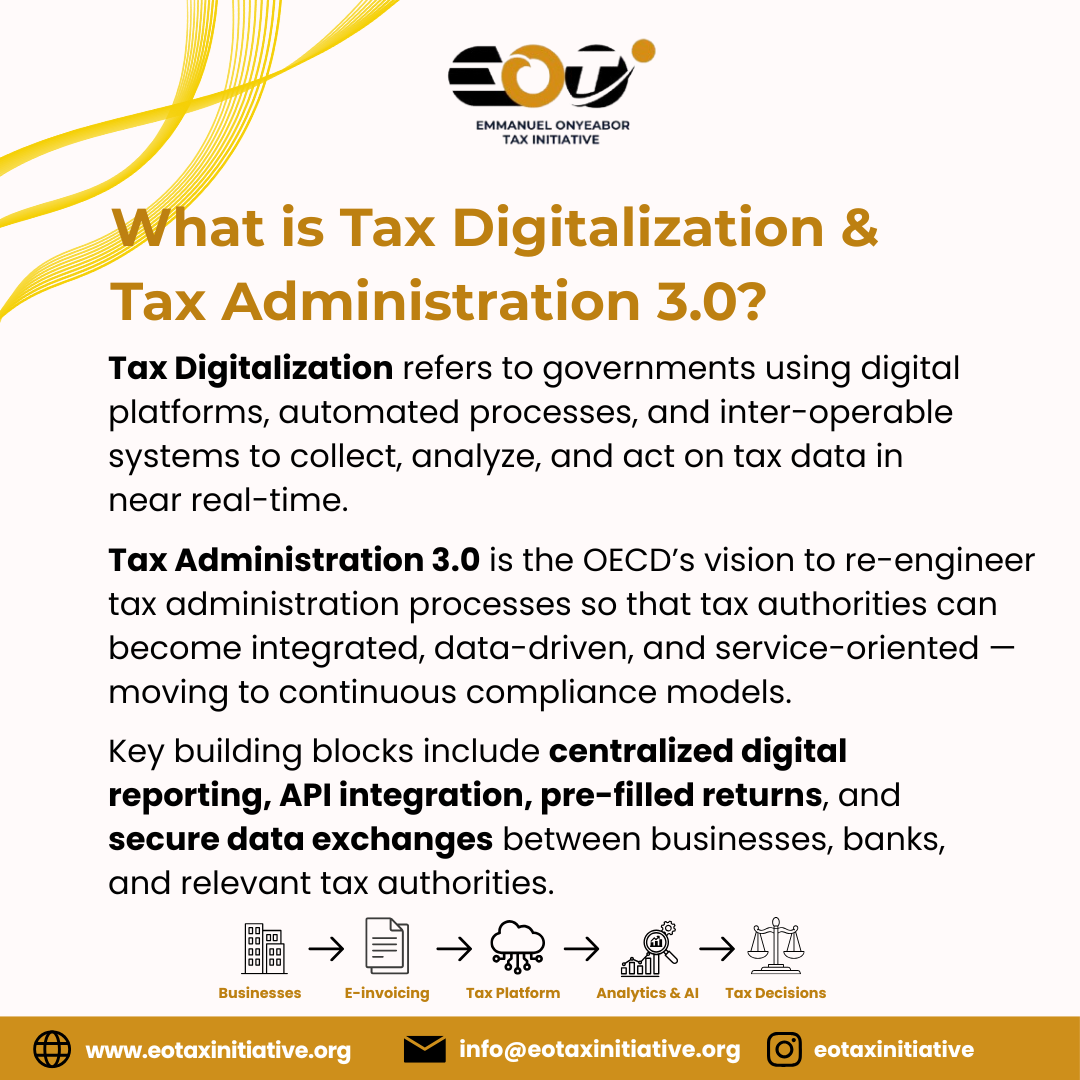

Tax Digitalization refers to governments using digital platforms, automated processes, and inter-operable systems to collect, analyze, and act on tax data in near real-time. Tax Administration 3.0 is the Organization for Economic Cooperation and Development (OECD)’s vision to re-engineer tax administration processes so that tax authorities can become integrated, data-driven, and service-oriented – moving to continuous compliance models. Key building blocks include centralized digital reporting, Application Programming Interface (API) integration, pre-filled returns, and secure data exchanges between businesses, banks, and relevant tax authorities.

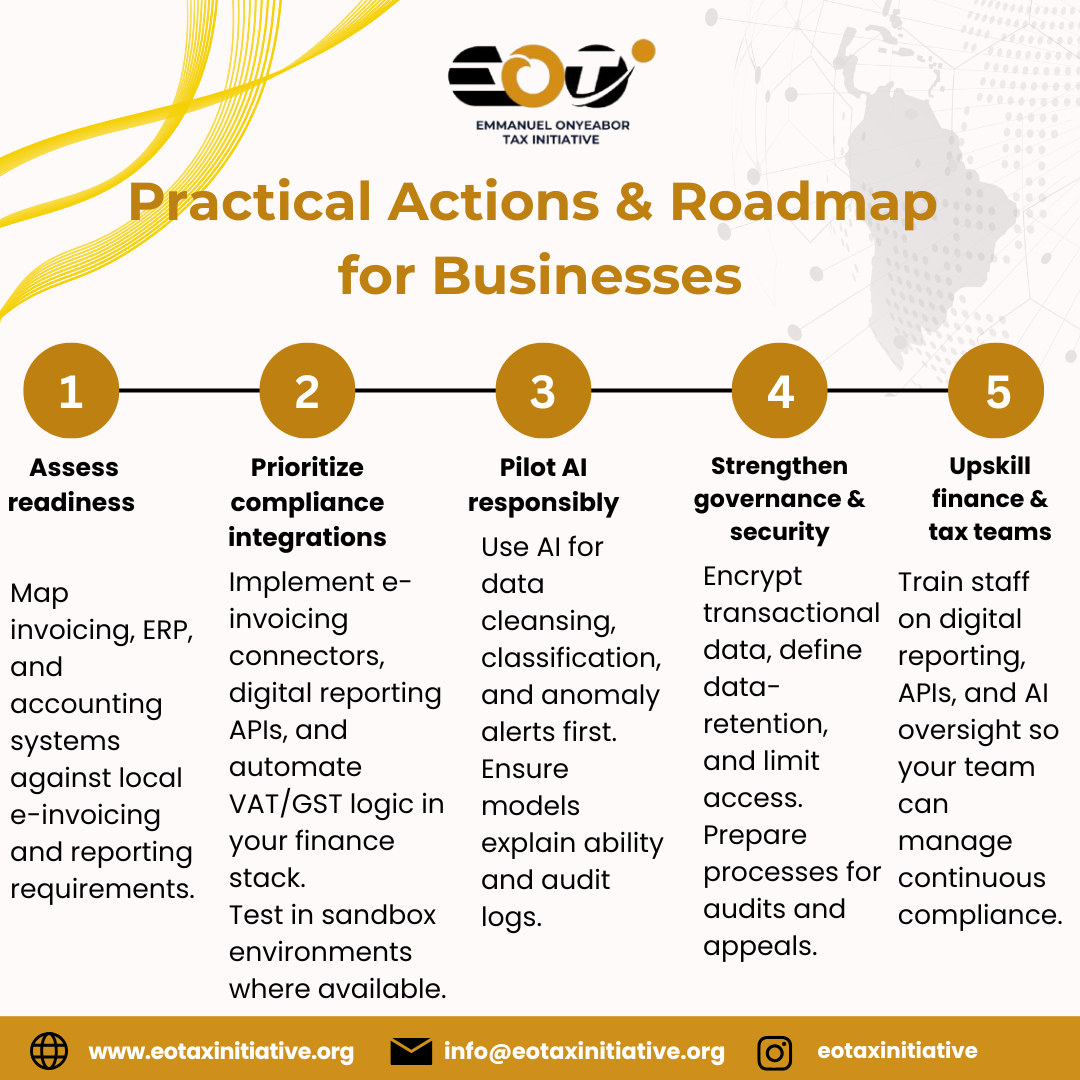

We have, in the attached carousel, provided highlights of: (a) core technologies powering the change; (b) benefits and opportunities for governments and businesses; (c) risks, costs, and governance challenges; and (d) practical actions and roadmap for businesses. Read through and be informed.

Leave a comment