The One Big Beautiful Bill Act 2025 (OBBBA) introduces sweeping changes to the United States (US) tax compliance framework. It goes beyond administrative updates. For multinationals and businesses, this legislation alters the rules of cross-border reporting, profit allocation, and income recognition. The effects are significant enough to require a reassessment of corporate global tax strategies.

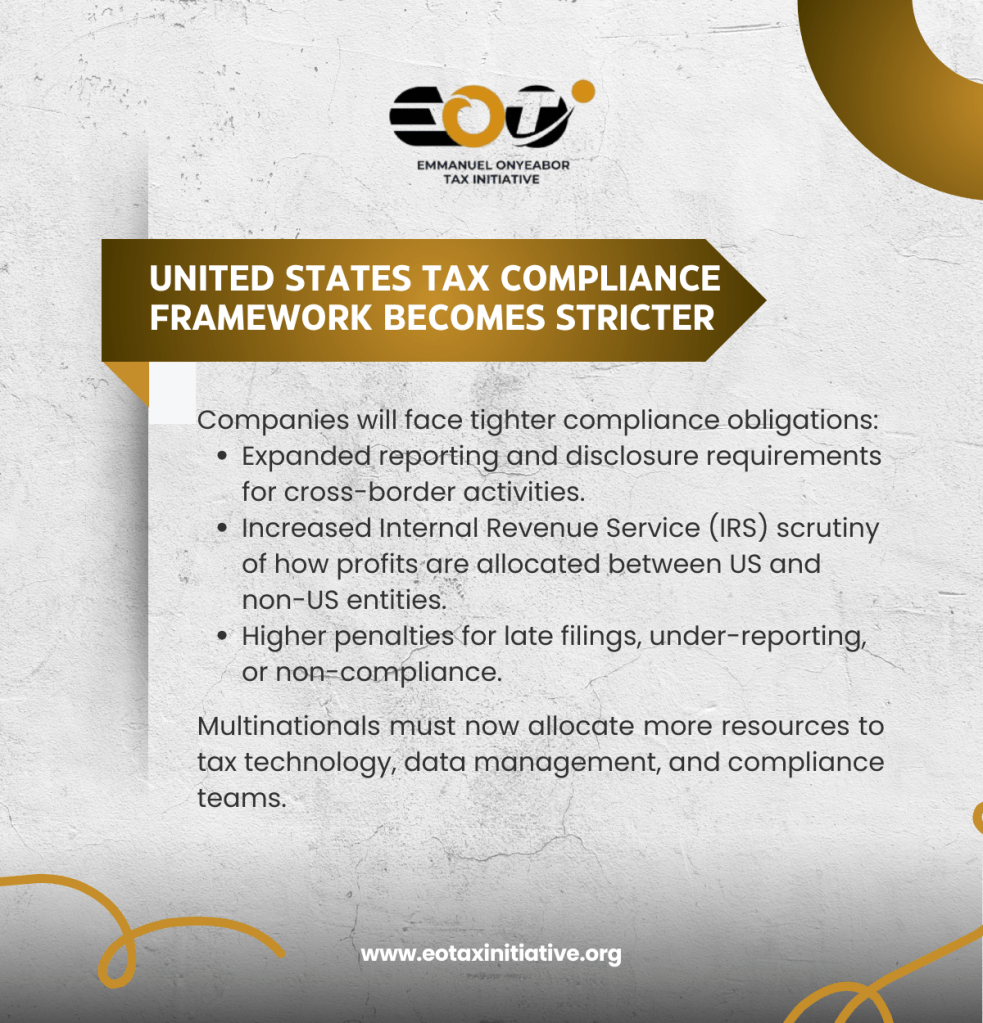

The OBBBA demands early action. Multinationals and businesses should: (i) conduct a full review of their global tax compliance structures and strategies; (ii) invest in optimal tax compliance systems and engage the services of skilled tax advisors; and (iii) anticipate indirect effects on cross-border trade, capital flows, and emerging market partnerships.

Those who adapt early will position themselves as both competitive abroad and compliant in the United States. This is essential for sustainable business growth.

We have provided a synopsis of the OBBBA’s compliance implications for multinationals and businesses in the attached carousel. Read through and be informed.

Leave a comment